Q3 2024 CEO LETTER

Chapter 3, 2024

I often view these MD&A updates as chapters in a book, a narrative that unfolds over time. This ‘book’ has six sections, starting in 2019, each year containing four chapters (quarters). When we launched this company in the shell of its predecessor, Freckle, the world was beginning to shelter in place as COVID-19 spread. Starting a nascent business during that time was challenging. Those first few years were capital-intensive and hard, and I am glad to have those years behind us. Business is never ‘easy,’ but evolving from concept to product to validation to now scale - all of these stages require very different tactics. I read the Berkshire, Dimon, Amazon, and other CEO letters each quarter and model this essay around those. I have always appreciated the opinions of those CEOs, who have a better vantage point than the media and have always found more knowledge in these letters than what is typically found in a research report or media article. As it relates to this industry and privacy, I would like to think that I sit on a perch that provides more visibility than most, so these quarterly letters are meant to share with you what I see. Take what you will from these thoughts and views; they are not all facts, and some are just opinions. Hopefully, they will allow you to understand this market better and make more informed choices regarding your investment in Reklaim and other companies you may be looking at.

As we conclude Chapter 3 (Q3-2024) and work through Chapter 4 (Q4-2024), I encourage investors to look at previous chapters to stay informed of the more prominent themes in the market that are impacting the Company today and in the future. Understanding the macro I highlight below will help you better understand the micro of Reklaim.

You have many choices as an investor; we appreciate you considering Reklaim.

The Market:

Q3 earnings reports from major advertising holding companies (Holdco’s) and platforms indicate that the market continues to expand at a ‘goldilocks’ pace, neither too hot nor too cold. These holding companies serve as reliable indicators of the advertising sector’s health, managing significant portions of corporate advertising budgets and comprising a portion of Reklaim’s client base. Notably, Publicis, one of the four leading Holdco’s, has raised its growth forecast for 2024 to approximately 5.5%. Recent Q3 results from Omnicom and Publicis revealed 5.6% and 6.5% growth, respectively, underscoring positive momentum across the sector. This sustained growth suggests a favourable market environment where Reklaim is positioned to outpace market averages. Reklaim's Q3 performance, with revenue growth exceeding 60%, demonstrates its ability to capture market share and adapt more swiftly to privacy-centric shifts, significantly surpassing the growth rates of established market players.

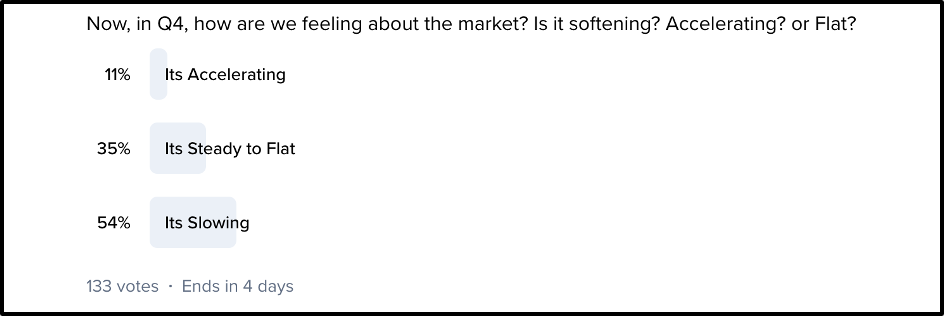

Looking ahead to Q4, the conclusion of political advertising— typically a significant driver of market activity in this quarter, though less so for Reklaim—will provide a clearer view of organic market growth as we approach 2025. While projections for Q4 remain positive, there are signs of concern among the seller community. Reklaim’s recent survey of 133 industry sellers highlights a potential market softening: 54% reported a slowdown in spending, 35% indicated stability, and only 11% observed growth. This is a slight improvement over our Q2 survey, which highlighted 63% of sellers thought the market was slowing. These insights from frontline sellers, who interact closely with market dynamics daily, underscore the need for cautious optimism. At Reklaim, however, we anticipate continued revenue acceleration, driven by an expanded network of sellers and increased brand recognition, positioning us to capitalize on broader market reach and deeper client engagement.

source: sellercrowd

The Open Web Is In BIG Trouble

In previous chapters, we discussed the impact of cookie removal on the open web and the advertising market. While Google has backtracked on this, there is a new threat that may turn out to be a larger risk than cookie depreciation: AI Overviews.

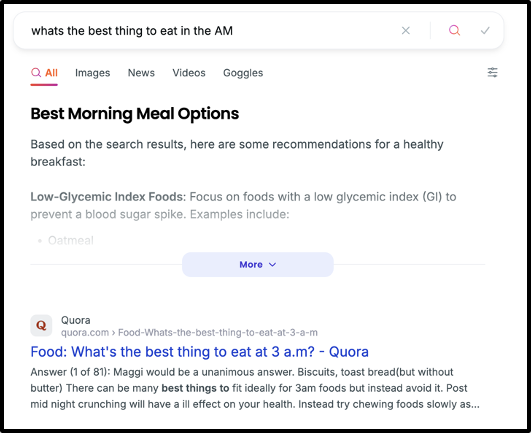

So, what exactly are AI overviews? Unlike traditional search results, where users enter a query and are presented with links to explore, AI overviews synthesize information from multiple sources and provide a complete answer directly in the search interface. Consumers no longer need to click through to publishers’ sites to get the information they want. For publishers, this change is seismic. We’re talking about a publisher model that sustains 50-70% of their traffic—and the ad revenue tied to it—being bypassed in a single AI stroke.

While AI overviews undoubtedly simplify the user experience by providing instant answers, they effectively act as a barrier, diverting traffic away from source sites and bottlenecking the flow of revenue back to publishers. The same search algorithms that once amplified publishers' reach now serve as gatekeepers, centralizing engagement at the search engine level and devaluing original content in the process.

The impact is immediate and severe: reduced traffic means reduced revenue. Less revenue forces publishers to cut back on staff and content production, perpetuating a vicious cycle—less content leads to even lower traffic, and the spiral continues. Without intervention, this will spell the end for many publishers, leaving the only place for neutral content, Facebook and other social networks!

The above is an example of an AI overview. The AI-generated response is at the top of the page, followed by a series of links (Quora). In most cases, the result supplied by the AI overview is sufficient for the consumer, reducing the need to click through to an article.

AI’s Insatiable Appetite for Data

One of the most paradoxical trends we're witnessing is the insatiable demand for data by AI systems, juxtaposed against the tightening grip of privacy laws. It’s ironic, really—AI depends heavily on the very content it now threatens to render obsolete through mechanisms like AI overviews. But here's the critical question: What happens when the well runs dry? Where will it turn when powerhouse publishers like The New York Times and others have exhausted their AI licensing deals, and AI has mined all available public content? Inevitably, AI will pivot towards more personal consumer data to keep evolving (training). This is where the collision between AI’s voracious appetite and the principles of privacy becomes unavoidable.

At Reklaim, we’re not just preparing for this shift—we're positioned at the forefront. Our platform empowers consumers to control and monetize their data, allowing brands to access it in a privacy-compliant, transparent manner. This consumer-first approach isn't just about consent; it's about rethinking the value exchange in a data-centric world. With potential expansion into facilitating consumer-approved data for AI training, Reklaim could tap into a substantial new revenue stream while adhering to high standards of data ethics and privacy.

Consider the scale: global investments in AI are forecasted to hit $500 billion by 2024, driven by industries scrambling for smarter, data-fueled models. Reklaim’s evolution could seamlessly align with this trend, leveraging consumer empowerment to redefine how data feeds into the next generation of AI.

We look forward to providing updates on these trends and our progress in Q4.

N